The growing financial links between Asia and the Middle East are poised to significantly influence global capital flows, according to new insights from HSBC. The accelerating collaboration between these two regions is already reshaping the landscape of international investments, with both sides benefitting from a convergence of economic goals, financial strategies, and geopolitical interests.

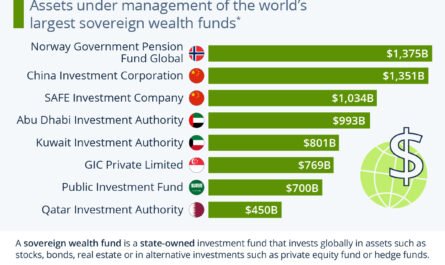

With Asia’s expanding markets and the Middle East’s substantial financial resources, the deepening investment ties present fresh opportunities, not only for direct capital inflows but also for new investment channels. Major players in the Middle East, particularly sovereign wealth funds (SWFs), have been actively looking to diversify their portfolios beyond oil and gas, seeking high-growth potential sectors across Asia. On the other hand, Asian countries are eager to tap into Middle Eastern capital to support infrastructure development, technology advancements, and other sectors critical to their long-term economic growth.

Sovereign wealth funds, such as the Abu Dhabi Investment Authority (ADIA) and Saudi Arabia’s Public Investment Fund (PIF), have been pivotal in this transformation. These funds, with trillions of dollars in assets under management, are increasingly directing capital towards emerging markets in Asia, specifically in technology, renewable energy, and other non-oil sectors. By doing so, they are securing a more diversified and sustainable investment outlook for the future. In addition to traditional investments, these funds have been key players in venture capital and private equity deals, making substantial contributions to Asia’s growing startup ecosystem.

The Middle East’s interest in Asian markets also aligns with broader regional strategies. China, India, and Southeast Asia represent some of the most dynamic economies in the world, with rapidly expanding consumer bases, technology sectors, and infrastructure needs. These markets are projected to be the largest drivers of global growth over the next few decades. The Middle East sees this as an opportunity to position itself as a critical partner in the supply chains and development of these regions, while securing profitable investments.

China’s Belt and Road Initiative (BRI) has also been a catalyst for increased investment flows, particularly to the Middle East. This ambitious infrastructure project has paved the way for the construction of critical transport networks, energy infrastructure, and other projects linking China to the Middle East and Africa. As a key player in this initiative, China has attracted substantial funding from Gulf states, which see these projects as a way to expand their influence and diversify investments.

On the flip side, Asia’s demand for energy resources has fueled growing economic ties with the Middle East. Asian countries, including China, Japan, and South Korea, are the world’s largest consumers of oil and gas. The Middle East, with its vast reserves, continues to play a critical role in meeting Asia’s energy needs. This energy dependence forms the bedrock of their broader economic relationship, where trade and investment in energy infrastructure serve as key building blocks.

Beyond energy, the collaboration between the two regions is evident in technology, green energy, and infrastructure sectors. As the Middle East pushes for diversification, particularly through the Saudi Vision 2030 program, Asian companies have become critical partners in building smart cities, renewable energy projects, and tech-driven industries. The emphasis on sustainability and green energy development has further intensified the investment dialogue, with Gulf countries looking to invest in Asia’s growing clean tech sectors, while also collaborating on mutual energy goals such as reducing carbon emissions.

The diversification of the Middle East’s investment strategies is also reflected in its increasing engagement with Asian financial markets. While traditionally, Gulf investors have placed a substantial portion of their capital in Western markets, Asia now represents a more attractive destination. With the region’s low interest rates and the ongoing recovery from the pandemic, Asian financial markets have provided better returns on investment for Middle Eastern funds.

According to financial analysts, the Middle East is also capitalizing on opportunities in Asia’s booming fintech sector. Middle Eastern investment in fintech has risen dramatically over the past few years, with major funds backing startups across Southeast Asia and India. This trend highlights the importance of innovation in attracting capital, as Middle Eastern investors seek to diversify their portfolios in line with global technological advancements.

The Middle East’s strong diplomatic and economic influence in Asia is also driving greater collaboration in trade and investment. Various bilateral agreements between Gulf countries and Asian powerhouses like China and India have further solidified the bond between the regions, facilitating smoother financial transactions and enhanced strategic cooperation. These agreements, often accompanied by infrastructure and trade deals, provide a more secure foundation for sustained capital flows and long-term economic partnerships.