.png)

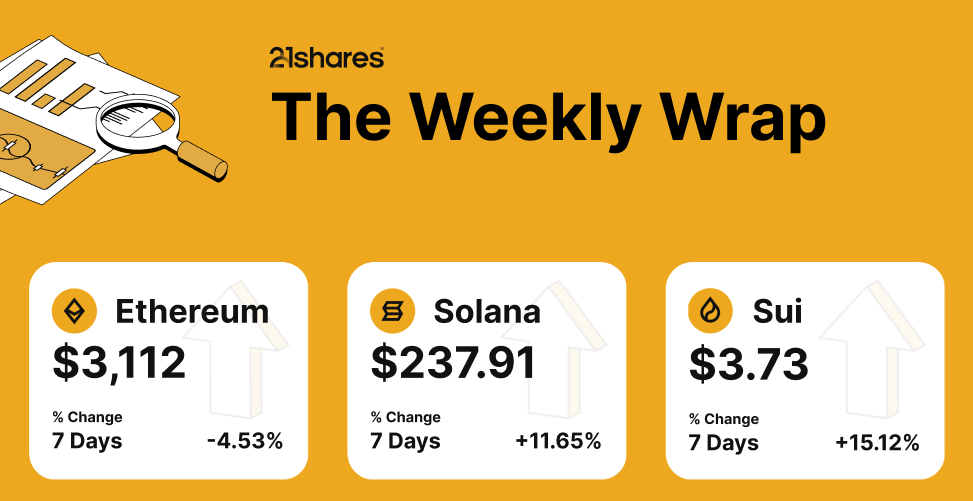

Solana’s decentralized finance (DeFi) ecosystem has surged in November, reaching $420.7 million in total value locked (TVL), significantly outpacing Ethereum’s $161.2 million for the month. This marks a sharp 161% increase in Solana’s DeFi earnings, largely attributed to its low transaction fees, high throughput, and a revival of its ecosystem following a challenging period.

Ethereum, long the dominant platform in the DeFi space, has faced stiff competition from Solana, whose technological upgrades and network enhancements have bolstered its position. As Ethereum continues to struggle with scaling issues and high fees, Solana’s faster and cheaper transactions have made it increasingly attractive to developers and users in the DeFi sector.

The dramatic increase in Solana’s DeFi activity is also a reflection of the broader recovery within its blockchain ecosystem, which was hit hard by a series of setbacks, including the collapse of the FTX exchange in late 2022. However, Solana’s resilience in recovering and innovating has allowed it to gain ground on Ethereum, traditionally the go-to platform for decentralized applications (dApps) and smart contract protocols.

Key factors driving Solana’s DeFi boom are its low transaction fees, which remain a major pain point for Ethereum users, especially during periods of high network congestion. While Ethereum’s gas fees can surge to hundreds of dollars for simple transactions, Solana offers an almost negligible fee structure, making it more attractive for smaller, retail investors and developers looking to build cost-efficient DeFi applications.

Solana’s speed is another competitive advantage. It boasts a transaction processing capability of more than 60,000 transactions per second (TPS), far exceeding Ethereum’s current capacity of 30 transactions per second, though Ethereum is working on scaling solutions such as sharding and layer 2 networks. Solana’s network speed allows for quicker and more scalable applications, which is crucial for DeFi protocols that require near-instant transactions to function efficiently, especially in volatile markets.

The ecosystem recovery of Solana has also been spurred by significant developments in its DeFi protocols. A growing number of decentralized exchanges (DEXs), lending platforms, and yield farming protocols have been launched or migrated to Solana’s blockchain, further boosting the platform’s TVL. Solana’s DeFi landscape has seen contributions from several key players, including Serum, Mango Markets, and Radium, all of which provide users with advanced trading options, liquidity, and competitive rewards.

Another contributing factor to Solana’s success is the strategic collaborations and partnerships it has secured with both established companies and up-and-coming startups. Solana has garnered attention from top-tier venture capitalists, along with prominent figures in the cryptocurrency space, who have supported the blockchain’s development and growth. These relationships have helped Solana gain credibility and foster an environment conducive to innovation and expansion.

The increase in DeFi activity on Solana has also been supported by growing interest in the broader Solana ecosystem. After a period of price volatility and uncertainty, Solana’s native cryptocurrency, SOL, has stabilized and regained much of its value. This recovery has sparked renewed confidence in the network and its long-term viability, which has translated into higher DeFi activity. As a result, users are increasingly willing to stake and invest in the network, propelling the overall market cap of Solana’s ecosystem.

Ethereum, on the other hand, continues to dominate the broader smart contract and dApp landscape, largely due to its first-mover advantage and large developer base. Ethereum’s switch to a proof-of-stake (PoS) consensus mechanism with the Ethereum 2.0 upgrade is expected to bring improvements in scalability and energy efficiency. However, Ethereum’s network congestion and high fees remain major hurdles for DeFi users and developers, especially in times of increased demand. These issues are likely to persist unless significant scalability solutions are implemented.

Although Ethereum has a stronghold on the DeFi sector, Solana’s rapid growth underscores the increasing diversification of the space. With its advanced technology, Solana is emerging as a serious challenger, offering viable alternatives for decentralized financial services. Furthermore, Solana’s growing TVL is not only a reflection of the platform’s technological edge but also an indication of the rising demand for alternative DeFi solutions that prioritize scalability, cost-efficiency, and innovation.

Experts suggest that the DeFi landscape is entering a new phase, where competition between smart contract platforms like Solana and Ethereum will be crucial to the long-term development of the ecosystem. As developers continue to search for faster, cheaper, and more scalable platforms, Solana’s performance in November provides a clear indication of the potential for DeFi to flourish on blockchains beyond Ethereum. The focus on speed and cost-effectiveness is expected to drive more DeFi protocols to explore alternatives to Ethereum, opening up the market to a wider range of participants.