By K Raveendran

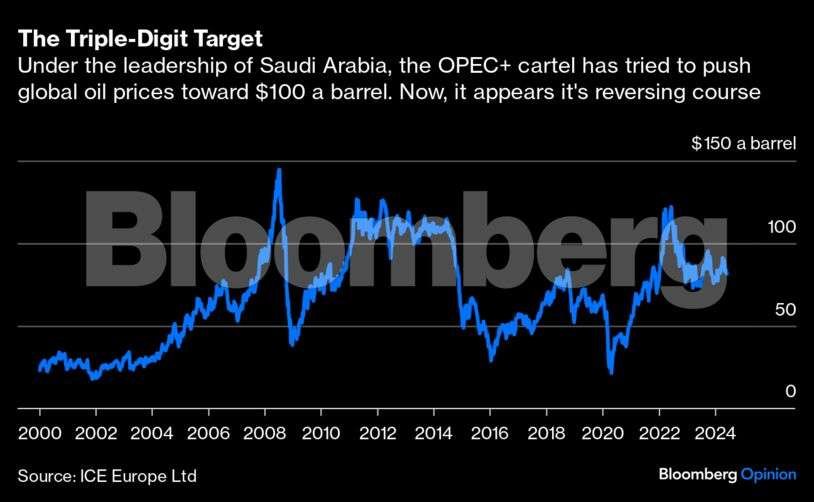

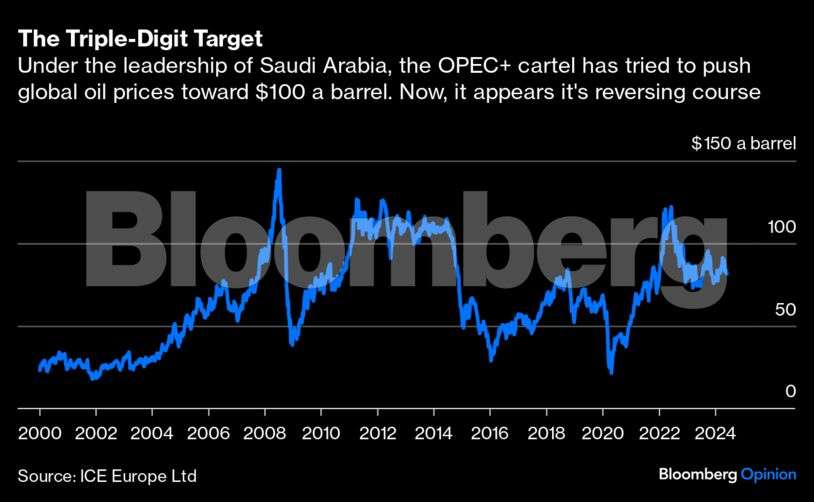

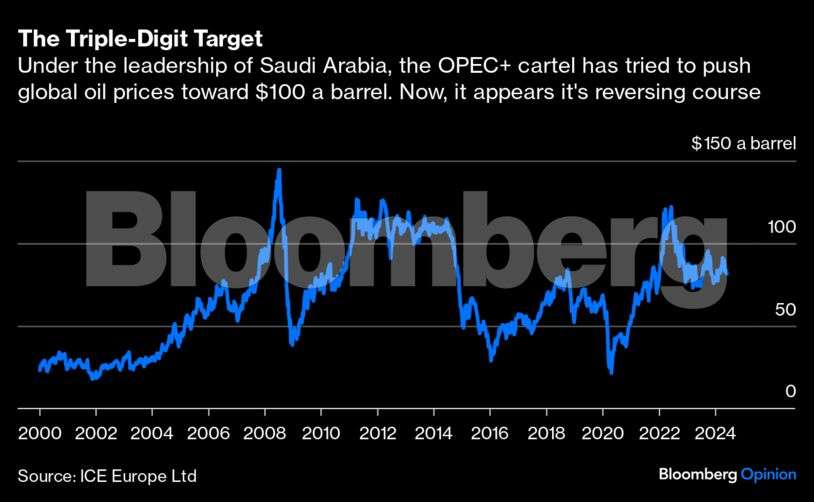

OPEC+ has recalibrated its production strategy, extending voluntary output adjustments to stabilize oil markets in the face of uncertain global demand and geopolitical pressures. The alliance’s decision to prolong cuts until the first quarter of 2025 aims to counterbalance potential oversupply and demand fluctuations, particularly linked to Donald Trump’s policies and China’s economic challenges.

The alliance’s move to extend production cuts until the first quarter of 2025, in response to weak demand—especially from China—can be attributed in part to the broader geopolitical and economic forces that have been set into motion under Trump’s leadership, as well as the ongoing uncertainty that his influence continues to inject into oil markets. The group’s aim to prevent a supply glut amid the uncertainty over China’s economic recovery is indicative of how policy decisions made in Washington still hold considerable sway in the energy landscape.

At the heart of OPEC+’s recent adjustments are two critical decisions made during the group’s virtual meeting. The first is the extension of the voluntary production cuts of 1.65 million barrels per day (bpd), which were initially announced in April of the previous year, and now extended until December 2026. This decision serves as a preventive measure to avoid oversupply, particularly as the global economy grapples with a slow recovery from the pandemic and ongoing supply chain disruptions. The second adjustment, made in November 2023, involves an additional voluntary cut of 2.2 million bpd, which will continue until March 2025, with a shift in the phase-out date from September 2025 to September 2026. These production adjustments are designed to signal to the market that OPEC+ is committed to maintaining stability in oil prices, even if global demand remains unpredictable in the short term.

The strategic rationale behind these cuts is to send a clear message to the market that OPEC+ is taking steps to mitigate any downside risk in the price of crude oil. The group is clearly mindful of potential oversupply concerns, especially with the rise in oil production from non-OPEC+ countries such as the United States and Russia. However, the decision to extend these cuts until the end of 2026 hinges on a number of factors, many of which depend on the actions and rhetoric of the incoming U.S. administration.

Trump’s 2.0 policies—particularly his stance on U.S. production growth, sanctions on key oil-producing countries like Iran and Venezuela, and trade tariffs on major oil exporters such as China—continue to be a point of concern for the global oil market. His hardline approach towards Iran and Venezuela, in particular, has significantly impacted the global supply chain, with OPEC+ members keenly aware of how the U.S. sanctions on these countries have reduced their oil output and disrupted global supply dynamics.

On one hand, Trump’s tariffs and sanctions have created volatility in global oil prices, which often leads to sharp fluctuations in both demand and supply. On the other hand, his policies have led to a situation in which the U.S. has become more energy independent, with the shale boom increasing domestic production. This has contributed to a more complex oil market, where the traditional influence of OPEC+ on prices is counterbalanced by U.S. production. However, given the uncertainty around Trump’s approach to energy diplomacy, particularly regarding his stance on relations with China, Venezuela, Iran, and Mexico, OPEC+ has opted to take a cautious approach. Their decision to extend production cuts signals the group’s desire to maintain control over price fluctuations, despite the ongoing geopolitical pressures.

While OPEC+ appears to be signalling a longer-term commitment to managing the market, not everyone is entirely convinced that the group’s strategy will have the desired effect. For instance, Morgan Stanley recently revised its Brent crude price projection for the second half of 2025 to $70 per barrel. The bank cited broader supply-demand dynamics, which have been affected by a number of factors, including shifting global supply chains, the rise of alternative energy sources, and the evolving geopolitical landscape. This cautious optimism reflects concerns about the long-term stability of the oil market, particularly with the increasing push toward renewable energy and the uncertainty surrounding geopolitical tensions in key regions like the Middle East and Eastern Europe.

One of the countries most impacted by fluctuations in oil prices is India. As one of the largest importers of crude oil, India’s economy is closely tied to global oil prices. India’s oil import bill has traditionally accounted for a significant portion of its overall import costs, and any increase in oil prices exacerbates the country’s trade deficit and inflationary pressures. This has been especially problematic in recent years, with the Indian economy already facing challenges such as a slowing GDP growth rate, a volatile currency, and high inflation. For India, lower oil prices provide some breathing room for the government to manage its fiscal policies without further increasing inflation or stoking public discontent. The Reserve Bank of India, in its recent monetary policy meetings, has expressed concern over the impact of higher oil prices on inflation, especially given the current economic slowdown.

The depreciating value of the rupee relative to the U.S. dollar has made oil imports even more expensive, further straining the country’s balance of payments. The Reserve Bank of India has been forced to raise interest rates to curb inflation, which in turn risks further slowing economic growth. In this environment, lower oil prices provide a welcome respite for the Indian economy, allowing policymakers to focus on addressing other structural issues without the added burden of rising fuel costs.

The market response to OPEC+’s decision has been somewhat muted. While the production cuts are intended to provide stability and avoid a price downturn, it remains unclear whether these efforts will be sufficient to counterbalance the broader forces at play in the global energy landscape. As the world transitions to alternative energy sources and the U.S. continues to ramp up its oil production, the long-term effectiveness of OPEC+’s strategy is uncertain. What is clear, however, is that the decisions made by the group are closely linked to the broader geopolitical context, with Trump’s policies on energy and trade playing a significant role in shaping the market dynamics. In this environment, India’s concerns about oil prices remain central to its economic strategy, with lower crude prices offering some relief to an economy that is already grappling with multiple challenges. (IPA Service)