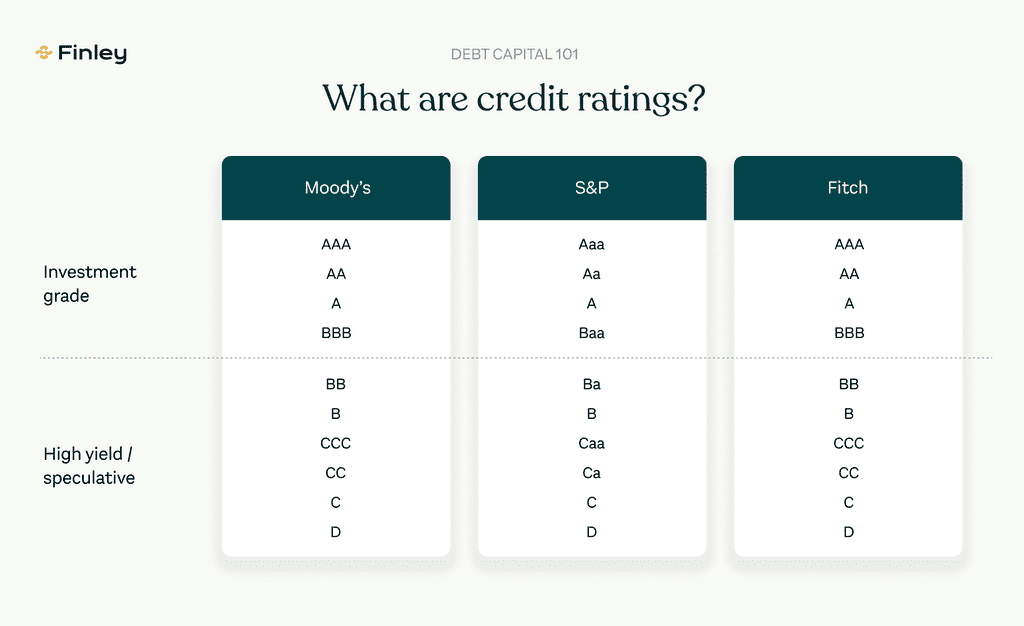

Kuwait’s creditworthiness received a vote of confidence from Fitch Ratings, a leading credit rating agency. On Friday, March 15, 2024, Fitch affirmed the country’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘AA-‘. This rating indicates a very low likelihood of default on sovereign debt obligations.

The positive assessment hinges on Kuwait’s exceptionally strong financial position. The nation boasts one of the most robust fiscal and external balance sheets among countries rated by Fitch. This strength is largely attributed to Kuwait’s sovereign net foreign assets, which are projected to remain exceptionally high at an average of 529% of GDP over the next two years. The vast majority of these assets are managed by the Kuwait Investment Authority (KIA), a sovereign wealth fund.

However, the rating is not without its qualifications. Fitch acknowledges that Kuwait’s dependence on oil revenue presents a vulnerability. Over-reliance on a single commodity can expose a nation to price fluctuations and long-term market shifts. Additionally, the agency highlights the potential challenges posed by Kuwait’s generous social welfare programs and a large public sector. Maintaining these programs while ensuring fiscal sustainability could prove difficult in the long run.

Another factor tempering Kuwait’s creditworthiness is the nation’s political landscape. Fitch points to recurring political divisions between the elected parliament and the government. These divisions have historically resulted in frequent ministerial resignations and parliamentary dissolutions, hindering progress on crucial economic and fiscal reforms. The recent parliamentary dissolution in February 2024, with upcoming elections scheduled for April, exemplifies this ongoing challenge. Fitch anticipates that the upcoming elections will likely yield a parliament similar to previous ones, where a majority of members are critical of government policies. This could further impede the implementation of necessary reforms.

Despite these constraints, Fitch maintains a stable outlook for Kuwait. The agency believes that the country’s exceptionally strong financial buffers will provide a significant cushion in the face of potential challenges. However, Fitch emphasizes the importance of addressing the aforementioned vulnerabilities, particularly the heavy reliance on oil and the need for fiscal and economic reforms. Implementing these reforms would strengthen Kuwait’s long-term economic prospects and potentially lead to an upgrade in its credit rating.