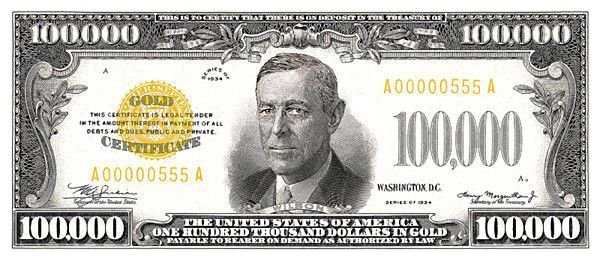

Bitcoin’s ambitious march toward the $100,000 mark has hit significant resistance, with market analysts pointing to liquidity constraints and macroeconomic pressures as key factors tempering the rally. Despite a sustained bull run earlier this year, momentum has slowed as traders assess global monetary conditions and broader economic trends.

Cryptocurrency markets often mirror liquidity flows in global financial systems, and Bitcoin’s performance has shown sensitivity to tightening conditions. Market experts highlight that diminished liquidity, compounded by a robust U.S. dollar and increasing bond yields, is exerting downward pressure on risk assets, including cryptocurrencies. Jamie Coutts, a seasoned analyst, noted that liquidity metrics have displayed bearish signals since October, suggesting a challenging environment for Bitcoin in the short term. These constraints may persist for the next several months as markets recalibrate.

Nvidia’s stalled stock rally has also influenced Bitcoin’s trajectory, reflecting broader investor caution. The chipmaker, which has been pivotal in the AI and tech boom, has seen a slowdown in its market performance. This deceleration is significant because a portion of crypto enthusiasm is linked to advancements in AI and related sectors, intertwining tech equities with digital currencies.

Bitcoin’s macroeconomic backdrop is further complicated by external geopolitical and fiscal factors. The U.S. Federal Reserve’s policies, alongside potential shifts in global trade and political landscapes, are shaping the risk appetite across asset classes. Coupled with the anticipation of regulatory developments in major markets, these elements contribute to the uncertainty engulfing Bitcoin’s upward potential.

Arabian Post – Crypto News Network

Notice an issue?

Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don’t hesitate to contact our editorial team at editor[at]thearabianpost[dot]com. We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity.