Dubai’s iconic skyline, forever chasing the clouds, is witnessing a new kind of gold rush. This time, however, the prospectors aren’t panning for precious metals, but for prime real estate. High-net-worth individuals (HNWIs) and foreign investors are flocking to Dubai and its Emirati neighbor, Abu Dhabi, drawn by a unique allure: luxury properties priced competitively against the global market.

The trend isn’t merely a trickle; it’s a full-fledged current. Knight Frank, a leading property consultancy, reported an 89% surge in Dubai’s prime property prices over the past year. This growth isn’t driven by domestic speculation, but by an influx of international buyers. Buoyed by Dubai’s pandemic-resilient policies and openness to foreign investment, these wealthy individuals are viewing the emirate as a haven for their assets, and a luxurious one at that.

Dubai’s transformation into a global magnet for the rich isn’t accidental. The emirate has cultivated an image of sophisticated living, boasting world-class amenities, a thriving business environment, and a tax-friendly haven. For millionaires and billionaires navigating an increasingly volatile global landscape, Dubai’s stability and sunshine become even more appealing.

Beyond the glitz and glamour, Dubai offers a surprisingly practical value proposition. Compared to established luxury property markets like London or New York, Dubai presents the opportunity to acquire a high-end property at a relative discount. This affordability, relative to other hubs, unlocks a wider pool of potential buyers. While multi-million dollar penthouses might remain exclusive, the accessibility of Dubai’s luxury market is undeniable.

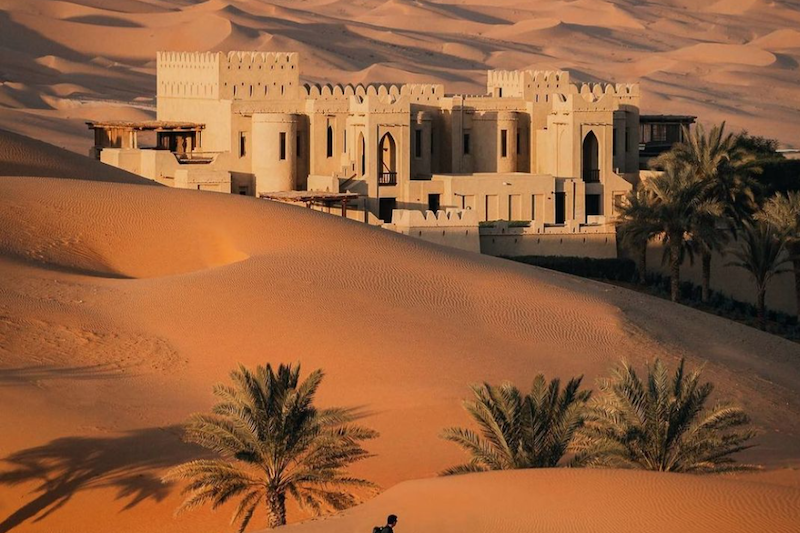

The trend extends beyond Dubai’s borders. Abu Dhabi, the capital of the United Arab Emirates, is witnessing a similar phenomenon. While traditionally known for its oil reserves and political clout, Abu Dhabi is making a name for itself as a cultural and business destination. This newfound dynamism, coupled with its proximity to Dubai, is luring investors seeking a quieter alternative, yet with access to the same regional advantages.

The surge in demand has outpaced supply in some segments of the market, particularly waterfront properties. Developers are wary of oversaturation, having witnessed the pitfalls of previous boom-and-bust cycles. This cautious approach, while potentially dampening short-term growth, fosters a sense of long-term stability for investors, a crucial factor for those placing substantial bets on a new market.

Dubai and Abu Dhabi’s ascent as luxury property havens is a testament to their strategic reinvention. By offering a compelling blend of lifestyle, investment potential, and affordability, these desert cities are carving a unique niche in the global playground of the wealthy.