A stronger relationship helps drive better business outcomes.

- More than 86% of EMEA CFOs and CIOs surveyed say their relationship has strengthened, with 43% of CFOs linking it to improved business outcomes.

- 42% of EMEA CIOs are tackling rising IT costs with investments in emerging tech.

Rimini Street, Inc. (Nasdaq: RMNI), a global provider of end-to-end enterprise software support, products and services, the leading third-party support provider for Oracle and SAP software, and an AWS partner, has announced the findings of the Censuswide survey “EMEA C-suite Imperatives: Evolving IT and Enterprise Investments.” The Rimini Street-sponsored research surveyed more than 1,500 CIOs and CFOs across the EMEA region, examining the relationship between these key decision-makers and the drivers behind their technology investments and decisions.

The data reveals that as costs rise, more CFOs are taking responsibility for underlying technology decisions to achieve business results. Although the entry of CFOs into the IT domain could create friction between the two parties, the data saw both sets of decision-makers saying that their relationship has strengthened, leading to positive results for the organisation. This collaboration is a critical leap forward as EMEA businesses attempt to tackle the challenges of rising costs and investments that fail to deliver expected business value and outcomes.

Analysis of survey responses reveals some key insights:

The CFO and CIO Partnership Continues to Strengthen, Leading to Improved Business Outcomes

More than 86% of CFOs and CIOs surveyed in EMEA say their relationship has strengthened1

Of the business and IT leaders who believe their bond has strengthened, 40% say it was due to a shared focus on security, compliance and risk. The improved bond jumps to 96% across the Middle East region, the highest globally, and drops to 76% in France. Meanwhile, overall, just 13% claim the relationship is slightly or much worse.

A stronger partnership leads to stronger results:

- 43% of CFOs believe the positive CFO/CIO relationship was the reason for improved business outcomes

- 36% of CFOs consider CIOs as innovative change-agents who drive business strategy.

Clear Communication and Mutual Understanding Are Key to Stronger Collaboration

An area of the CIO/CFO relationship that shows room for improvement is communication:

- 85% of CFOs say their CIO counterpart needs to be more business savvy to better communicate with them, with the percentage dropping to 79% in the UK

- 87% of CIOs want their finance colleagues to be more technology savvy, with the percentage increasing to 94% in the Middle East

“Everyone says they know the value of good relationships and collaboration, but people rarely link it to business impact,” said Rimini Street’s EMEA GM & GVP, Martyn Hoogakker. “Being able to discuss ideas, get feedback and understand how all aspects of the organisation align greatly increases the chances of success. Central to that is good communication. It’s clear from the results that a greater understanding of areas outside our own business functions can facilitate a greater sharing of knowledge, get key stakeholders onside and secure the IT investment EMEA businesses need. Do that, and businesses can benefit from improved business outcomes such as greater profitability and growing revenues.”

CIOs Are Focused on Solving Rising IT Costs with Emerging Tech and Outsourcing

EMEA CIOs are investing in emerging technologies (42%) and increasing spending on SaaS and cloud services (42%) to tackle growing IT costs.

Technology leaders are turning to emerging tech, such as artificial intelligence (AI), to address rising IT costs and talent and labor shortages. However, such investments are not being made haphazardly. CIOs realise that having clean, accurate data is the first step to achieving their AI dreams.

While nearly 88% of CIOs agree that historical data is the key to maximising the value of their AI projects for ERP, 93% state that their data requires a substantial or moderate clean-up for their AI projects to succeed. The Saudi Arabia’s CIOs were most positive about their data, with 15% considering it in decent shape for AI projects.

Another area of focus for EMEA CIOs is improving cost predictability by outsourcing IT services. Tech leaders state that outsourcing helped solve the loss of IT talent and staff, and 26% say they were able to lower costs with IT outsourcing. CIOs report many benefits from outsourcing, including:

- Support of application customisations (36%)

- Broader service and support solutions (32%)

- Better quality of service and support (33%)

- Faster resolutions (29%)

Not All Technology Initiatives Are Delivering Value for the Business

ERP upgrades or migrations and Mobility (both 23%) delivered the least amount of value for CFOs in EMEA.

Only 19% of EMEA CFOs state that they are happy with the results of their technology investments. Many experienced a negative impact from IT investments, such as an increase of new and ongoing costs, unforeseen limitations on system flexibility and significant organisational/business disruption. Middle East CFO numbers are slightly higher, with nearly a quarter (24%) saying they are happy with their tech investment returns.

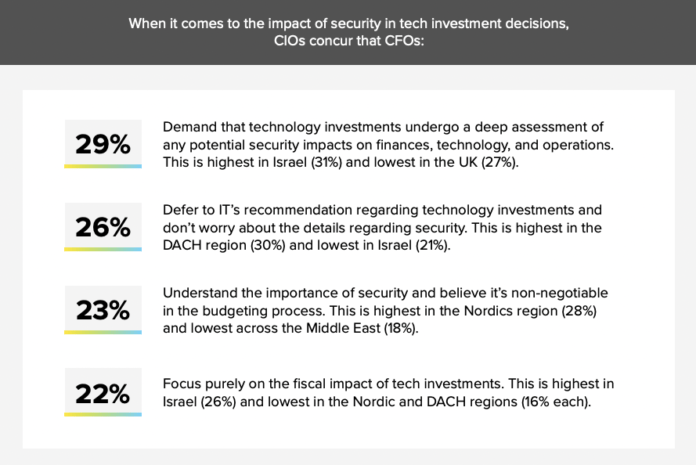

This dissatisfaction could be a motivating factor for CFOs taking a more prominent role in the decision-making of IT investments. The data shows 73% of CFO survey respondents say they now take the lead in setting technology budget levels.

According to the surveyed CFOs, the top three technology investments that delivered the highest value for the business include:

- Security (27%)

- Compliance and risk management applications (26%)

- Customer-facing SaaS technologies (26%)

The investments least likely to drive value were ERP upgrades or migrations and mobility technologies (23% each).

“In this highly competitive business landscape combined with continued cost pressures, CFOs and CIOs must be ruthless about the ROI of every investment, driving growth and profitability with each decision made,” said Rimini Street’s EVP and Chief Financial Officer, Michael Perica. “A strong CFO/CIO collaboration focuses on both short and long-term success for the business, leading the team through economic challenges, market fluctuations and uncertainties with confidence.”