Global digital asset funds witnessed a net outflow of $251 million this week, according to data compiled by CoinShares. This stands in stark contrast to the substantial inflows observed in Hong Kong’s new exchange-traded funds (ETFs) that track prominent digital assets such as Bitcoin and Ether. The outflows signal a cautious approach among some investors in the digital asset market, while the inflows into Hong Kong’s ETFs underscore the growing appetite for regulated investment products in this domain.

Analysts attribute the outflows from digital asset funds to a confluence of factors. The recent volatility in the crypto market, with Bitcoin prices plunging below $40, 000, has instilled a sense of apprehension among investors. Regulatory uncertainties surrounding the crypto space in certain jurisdictions have further dampened investor sentiment.

Conversely, the inflows into Hong Kong’s ETFs are attributed to their regulated nature. These ETFs are subject to stringent oversight by the Hong Kong Securities and Futures Commission (SFC), which offers investors a layer of security. Additionally, these ETFs provide a convenient and accessible avenue for investors to gain exposure to the digital asset market without the complexities of directly owning and managing cryptocurrencies.

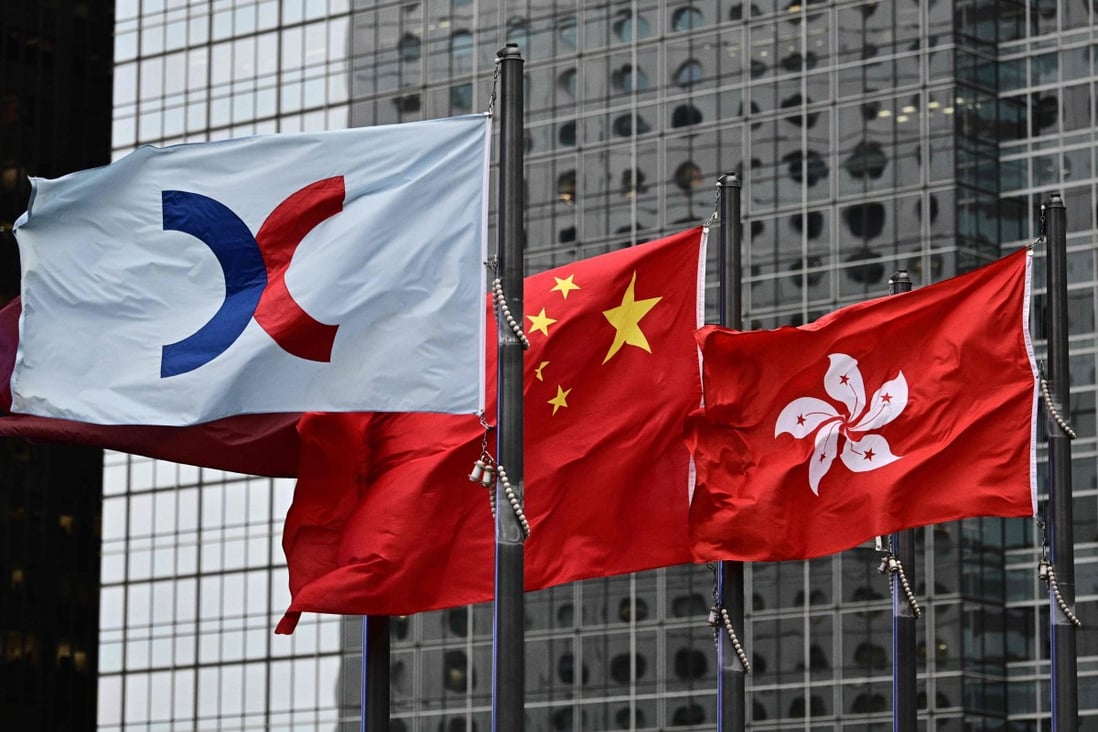

The SFC’s pro-crypto stance has also played a role in attracting investment to Hong Kong’s ETFs. The regulatory body has adopted a relatively accommodating approach towards cryptocurrencies compared to other jurisdictions. This has positioned Hong Kong as a potential hub for digital asset innovation and investment.

The contrasting trends in global digital asset funds and Hong Kong’s ETFs highlight a potential shift in investor preferences. While some investors are adopting a wait-and-see approach due to the prevailing market volatility and regulatory uncertainties, others are seeking out regulated investment products that offer a more secure and convenient way to participate in the digital asset market.

Looking ahead, the future trajectory of investments in digital assets will likely depend on several factors. Regulatory clarity from key jurisdictions, the overall performance of the crypto market, and the development of the digital asset ecosystem will all play a crucial role in shaping investor sentiment. It remains to be seen whether the cautious approach or the growing interest in regulated investment products will prevail in the digital asset market.