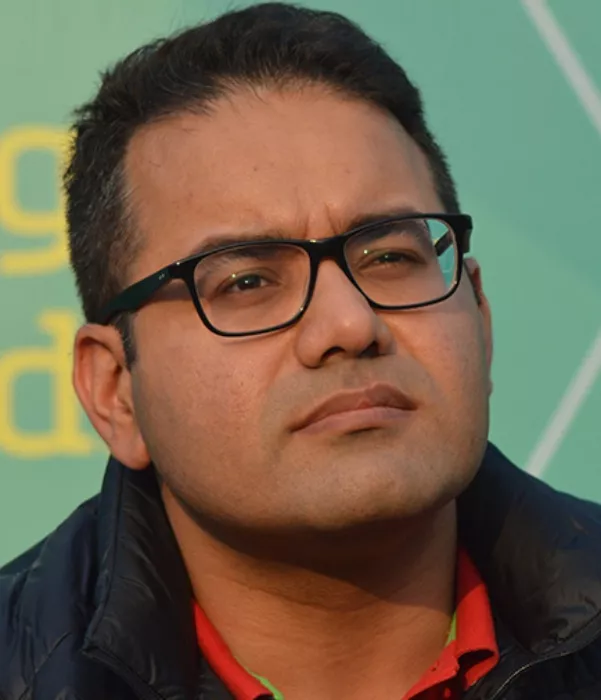

Kunal Bahl is among the most influential and admired investors in India. The ace entrepreneur is renowned for investing vast amounts of money in multiple companies. From studying in New Delhi to working at Microsoft and eventually kick-starting his entrepreneurial journey by co-founding two major companies, Kunal Bahl’s success story is an underrated gem that everyone needs to be aware of.

Kunal Bahl is one of the few businessmen in India, who are equally interested in investing and has created a name for himself in the business world. One can identify Kunal’s brilliance as an investor by the fact that he is going to be one of the judges on Prime Video’s business reality show, Mission Start Ab, which will premiere on December 19, 2023.

Recommended Read: Meet Sourav Joshi: Labourer’s Son, YouTube Success After 12th, Earns Rs. 80 Lakhs Per Month, More

As a result, today, we are going to decode the life and entrepreneurial journey of Kunal Bahl, who is one of the most successful investors in India. From his background and educational qualifications, young entrepreneurs can learn a lot about the business world. Thus, without further ado, let’s get straight into the details of Kunal Bahl’s personal and professional fronts.

Kunal Bahl’s educational qualifications

The esteemed entrepreneur, Kunal Bahl was reportedly born on January 1, 1984, in New Delhi. Not much information about his parents or family background is available in the public domain. Talking about Kunal’s educational qualifications, he completed his schooling at Delhi Public School, R.K. Puram. After which, Kunal went to the US, where he took admission to the University of Pennsylvania in the Jerome Fisher Programme in Management and Technology.

As per reports, Kunal Bahl earned two graduation degrees, one in business operations and data management (from The Wharton School) and the other one in engineering (from the School of Engineering and Applied Science). Not only this, Kunal also enrolled in Kellogg School of Management’s renowned executive marketing program in order to enhance his knowledge in the business world.

Kunal Bahl’s entrepreneurial journey: Corporate rebranding of Snapdeal to AceVector and co-founding Titan Capital

After completing his education, Kunal Bahl kick-started his professional journey by diving straight into entrepreneurship. It was the year 2010 when Kunal joined hands with Rohit Bansal and founded Snapdeal. Soon, the company became a household name across the country as one of the largest online marketplaces in India. The company was dominating India’s online marketplace as over 500,000 sellers and more than 3,700 towns were listed on Snapdeal.

Despite all the success that Snapdeal has achieved, a mere drop was seen in its growth as a company. From an unsuccessful merger with Flipkart to gaining little momentum with Snapdeal 2.0, Kunal Bahl and Rohit Bansal had tried almost everything to bring back their company’s golden days but couldn’t make it. As a result, it was Kunal, who changed the approach, and in 2022, Snapdeal underwent a corporate makeover. The brand got the group identity of AceVector, which featured multiple businesses like Unicommerce and Stellaro Brands under it.

The idea of corporate rebranding worked in Snapdeal’s favour as AceVector revolutionised the e-commerce space in India with the help of innovative distribution channels. Courtesy of his success with AceVector, Kunal Bahl was appointed as one of the members on the board of governors of the Indian Council for Research on International Economic Relations and the executive council of NASSCOM. In the following years, Kunal also held the position of Chairman of the Confederation of Indian Industry. Due to his exceptional expertise as an investor and entrepreneur, he is indeed one of the valuable contributors to the Indian startup ecosystem.

In 2015, when Kunal Bahl and Rahul Bansal were fresh from co-founding Snapdeal, they built another company from scratch, Titan Capital. The fund company was created to support entrepreneurs with innovative ideas and futuristic startup ventures financially.

You May Like This: Mahadev Book Betting App: How A Juice Corner Owner Became A Billionaire, Made Rs. 200 Crore A Day

Kunal Bahl’s journey as an investor so far: From Ola Cabs to investing in 280 businesses

Apart from his entrepreneurial success with Snapdeal, Kunal Bahl made a name for himself when he showed faith in Bhavish Aggarwal’s visionary business idea, Ola Cabs. Kunal introduced Ola Cabs to his close friend, Rahul Bansal, and together, they invested a sum of 60,000 USD in Bhavish’s business venture, Ola Cabs, and it turned out to be a masterstroke.

For the unversed, Ola Cabs reportedly made a revenue of Rs. 1,970 crores in FY22, which speaks volumes about the return on investment that Kunal Bahl and Rahul Bansal have received. As per multiple reports, Kunal has invested his money in 280 startups, whose valuation ranges from 100 million USD to 600 million USD. His faith in startups is one of the major reasons why Kunal is among the most respected investors in the startup ecosystem.

Don’t Miss: Anjali Pichai: Google’s CEO, Sundar Pichai’s Wife Whose One Advice Made Him Earn Rs 5 Crores Per Day

Kunal Bahl’s salary in crores

Talking about Kunal Bahl’s salary, he received an estimated fixed compensation of Rs. 3.5 crores, along with a performance bonus of Rs. 1.5 crores. As per reports, in FY2021, Bahl took home a sum of Rs. 3.5 crores as a part of the remuneration. Kunal is indeed among one of the richest investors in India, who is an inspiration for so many young investors and entrepreneurs across the country.

What are your thoughts on Kunal Bahl’s journey from Delhi’s DPS School to minting crores and investing in 280 companies? Let us know.

Also Read: Shocking Downfall Of Anil Ambani: From Being The Sixth Richest Man In The World To Going Bankrupt