Arabian Post Staff -Dubai

The International Air Transport Association (IATA) predicts a significant rise in profitability for Middle Eastern airlines in 2024. Their latest forecast anticipates a collective profit exceeding $3. 8 billion, a substantial 22. 5% increase compared to the $3. 1 billion earned in 2023. This positive outlook comes despite ongoing regional tensions, including the recent Israel-Gaza conflict.

This optimistic forecast for the Middle East is mirrored in the global airline industry. IATA has revised its global profit projection upwards to $30. 5 billion in 2024, surpassing the $27. 4 billion previously anticipated for 2023. The industry is expected to generate a record-breaking $996 billion in total revenue, with expenses reaching $936 billion. Passenger revenue is poised for a significant surge, reaching $744 billion, reflecting a 15. 2% increase from 2023’s $646 billion. Passenger traffic, measured in Revenue Passenger Kilometers (RPKs), is also expected to climb 11. 6% year-on-year.

Analysts attribute this industry-wide upswing to several factors. The easing of travel restrictions, particularly in Asia, has fueled a resurgence in passenger demand. Additionally, a stronger global economic recovery has boosted consumer confidence and willingness to travel. The ongoing conflict in Ukraine is expected to have a minimal impact on overall passenger traffic, with airlines likely to adjust routes to mitigate disruptions.

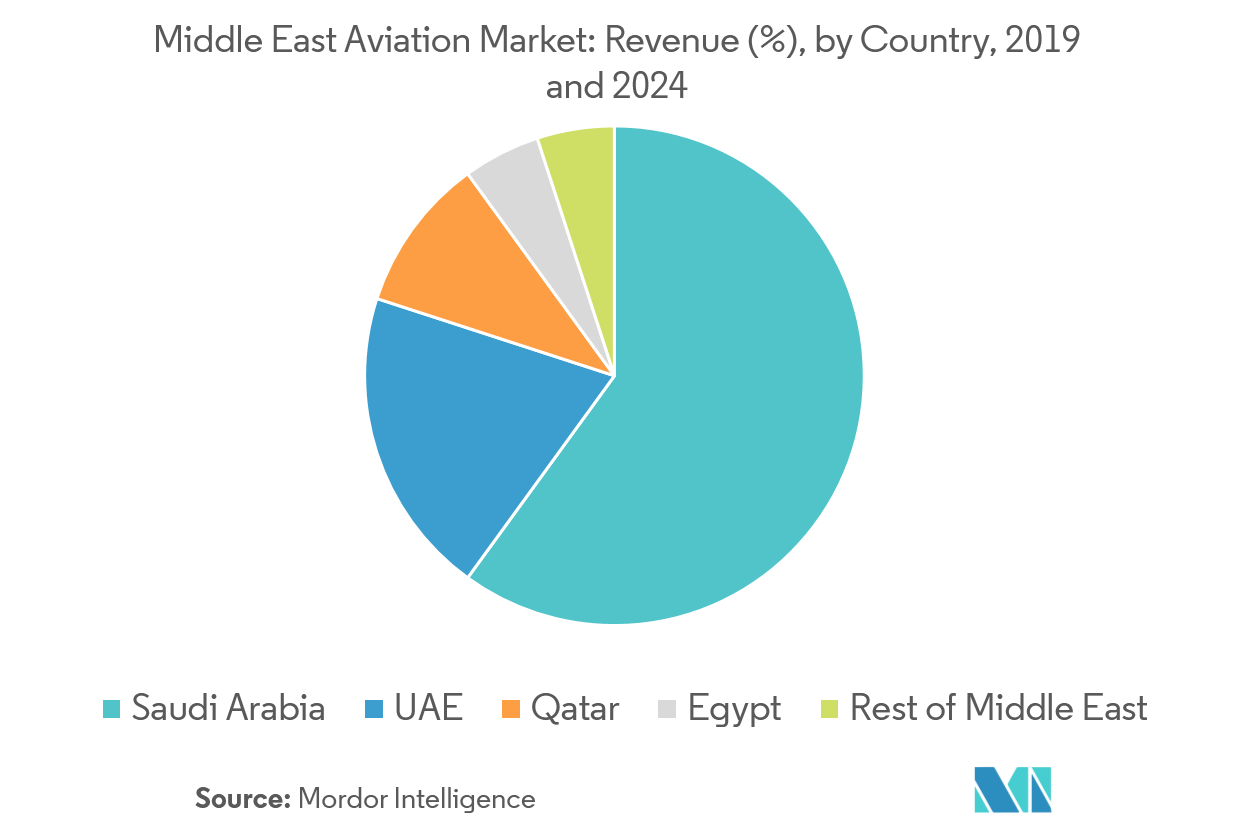

The Middle East’s projected profit surge is further bolstered by significant investments from key players in the region, particularly the United Arab Emirates (UAE) and Saudi Arabia. These countries have been actively expanding their aviation infrastructure and fleets, positioning themselves as major global travel hubs. Emirates Airlines, Etihad Airways, and Qatar Airways, all dominant carriers within the region, are expected to be significant beneficiaries of this investment boom.

The outlook for Middle Eastern airlines is not without challenges. Geopolitical tensions and volatile fuel prices remain concerns. However, the current climate suggests a strong year for the industry, with increased passenger traffic and strategic investments driving profitability. As the year progresses, the industry’s ability to navigate these challenges and capitalize on the current travel boom will be closely monitored.