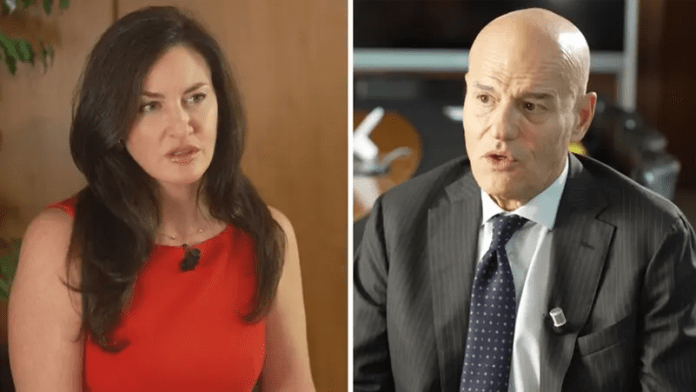

In an interview with Al Arabiya’s Hadley Gamble, ENI’s CEO Claudio Descalzi dispelled the notion that oil prices might hit $100 by the year-end despite escalating tensions in the Middle East.

“The market, at the moment, does believe that [the bombing of the Iranian oil facilities] can happen. That is my feeling”, he told Gamble.

Last week oil markets moved on comments from U.S. President Joe Biden suggesting an attack on Iran’s oil facilities was under discussion. Oil prices today remain elevated despite the white house later walking those comments back.

“That is dangerous, not just for the price. This is dangerous for a worldwide war… That is a is a clear, strong statement, a strong event”, Descalzi said.

Weighing in on the actual effect such speculation had on oil, he said it would pump up prices, but in a limited range. “We see their action was not so strong from a price point of view. Because if you pass from 74 to 79, or $78 that means that, okay, there is some fears. And you know, they use also algorithms. So this kind of statement can create in the algorithm the feeling to buy, buy, buy… But that means just a few dollars at the end of the day.”

Despite a “very volatile” oil market, Descalzi said demand is there. “At the moment we are about 103 million bar per day of demand, and by 2025, 104 million barrels per day. So the demand is there.”

Gamble quizzed the oil boss on the likelihood of oil prices reaching the $100 mark by the end of the year, given the volatile geopolitical landscape. Descalzi responded with cautious optimism about the stability of the market, saying, “No, I don’t think so, because we are still in a situation where it’s not clear what’s going to happen with the central banks in Europe in terms of reduction of interest. We saw in the US, 50 points is huge, so a huge reduction.”

Descalzi also highlighted the role China plays in global energy consumption, thereby directly impacting oil market forecasts. “I think that we have to understand how the growth is going to happen in China, because China, in any case, represents 25% of the consumption overall, with India as well”, he said.

A significant part of the discussion focused on the challenges and inadequacies in the upstream investment, posing a risk to future oil supply, potentially leading to higher prices if not addressed.

“The supply, in terms of investment for the upstream, are not really matching this kind of growth in demand. There is no big project. There is no a lot of investment in the upstream,” Descalzi pointed out.

“We are still investing less than in 2013 for example. So we are not able to replace the natural depletion of the field. We don’t have enough investment in new fields. There are a lot of m&a, but that means that we are not creating new reserves or new production.” Descalzi said. “So there is this gap.” He added.