Commercial Bank of Qatar has achieved a significant milestone in sustainable finance by issuing its largest green bond, valued at 200 million Swiss francs (approximately $220 million). This issuance reflects the growing commitment to environmental sustainability in the Middle East, positioning Qatar as a key player in the global green finance market. The bond will not only enhance the bank’s capital structure but also contribute to financing environmentally friendly projects, aligning with Qatar’s national vision for sustainable development.

The green bond market has been expanding rapidly in recent years, driven by increasing awareness of climate change and a collective push toward achieving net-zero emissions. The demand for green bonds has surged, with investors increasingly seeking sustainable investment opportunities. The success of Commercial Bank’s issuance is indicative of this trend, as it attracted significant interest from both local and international investors, highlighting a robust appetite for green investments.

This bond issuance is particularly significant as it is linked to projects that are in line with the Qatar National Vision 2030, which aims to transform the nation into a sustainable, diversified economy. The proceeds from the bond are earmarked for financing projects that contribute to environmental sustainability, including renewable energy initiatives, energy-efficient buildings, and other green infrastructure projects. Such initiatives are crucial for Qatar, a country that has been grappling with environmental challenges amid rapid economic growth.

Analysts note that the successful issuance of the green bond is expected to encourage other financial institutions in the region to explore similar funding avenues. As the Gulf Cooperation Council (GCC) countries increasingly focus on sustainability, there is a growing recognition of the need to diversify funding sources. The green bond market offers a viable solution, allowing institutions to raise capital while contributing to climate-related projects.

This move aligns with global financial trends, where sustainability is becoming a cornerstone of investment strategies. Financial institutions worldwide are pivoting towards responsible investing, which has become an essential aspect of portfolio management. The rise of Environmental, Social, and Governance (ESG) criteria in investment decisions further underscores this shift. The Commercial Bank’s initiative is a strong testament to this evolving landscape, showcasing how traditional banking institutions can play a pivotal role in advancing sustainable finance.

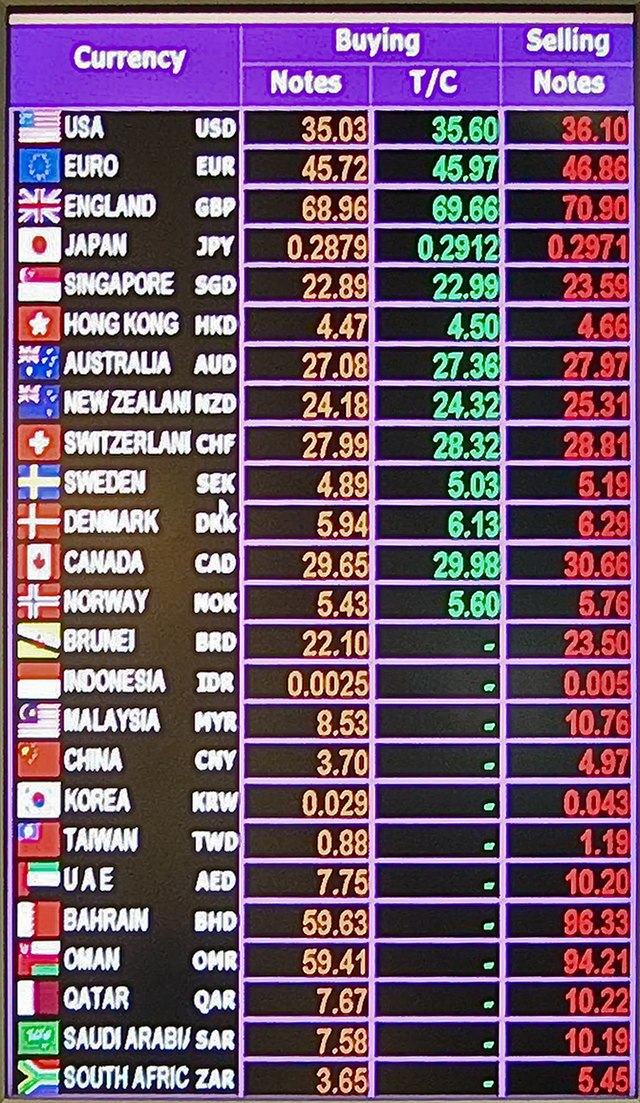

The Swiss franc denomination of the bond is also noteworthy, as it signifies a strategic choice to tap into a stable currency while appealing to a diverse investor base. The bond’s pricing was attractive, reflecting favorable market conditions and investor confidence. It is anticipated that the bond will yield competitive returns, making it an appealing option for investors looking to balance financial returns with sustainability goals.

The issuance has garnered positive feedback from environmental advocates, who see it as a step forward in mobilizing capital for green initiatives. Experts emphasize the importance of integrating sustainability into financial practices, arguing that the finance sector has a crucial role to play in addressing climate change. By facilitating investments in green projects, financial institutions can contribute to a more sustainable future.

The Commercial Bank’s move is not isolated; it is part of a broader trend where banks and financial institutions across the region are exploring green finance. The issuance of green bonds has gained momentum in various Gulf states, with several institutions launching their own green financing programs. This reflects a growing acknowledgment of the financial sector’s responsibility in promoting sustainable development and addressing environmental challenges.

In Qatar, the focus on green finance is underscored by the country’s ambitions to host the 2022 FIFA World Cup, which has catalyzed numerous infrastructure projects aimed at sustainability. The tournament has prompted investments in eco-friendly stadiums and facilities, further aligning with the global push for sustainability in large-scale events. The successful issuance of green bonds will likely support these initiatives, enabling the financing of projects that adhere to international sustainability standards.

Internationally, Qatar’s initiative to issue a green bond aligns with global efforts to mobilize private capital for climate action. Financial markets are increasingly recognizing the urgency of climate change, and initiatives like these are vital for achieving the targets set by the Paris Agreement. The involvement of commercial banks in green finance is critical for channeling funds towards renewable energy and other sustainable projects that can mitigate climate impacts.

The bond’s launch is also a signal to investors about Qatar’s commitment to sustainability, further enhancing its reputation as a leader in responsible finance. As more banks in the region pursue similar paths, it is expected that the dynamics of investment will evolve, with sustainability becoming a core component of banking strategies.